OfMoney

Responsibilities: product | UX | UI Customer project: yakov fridman

this project is currently in the design and developmant process. the case study presents the ux/ui process, and key insights gathered son far.

Be worth more money.

The Western world demands achievements and successes but admires consumerism and makes it the headlines. The race is never-ending. You want to buy and spend, because that's what everyone sees, but you also want to get rich and accumulate money. It's almost impossible.

OfMoney

ofmaoney aims to solve this paradox for Western society and offer it a solution that will change its economic life

business golas

Target audience

B2C

household managers

Business model

Revenue from product sales by users or advertising

A system that highlights your economic value

Differentiation

Uesrs research

To understand how people deal with this Western paradox, I conducted several interviews with different people, focusing on their overall experience rather than specifics, so that I could truly validate the client's main proposition.

Pain point 1

Lack of confidence in financial decisions- lack of information and guidance, and a sense of loneliness create uncertainty regarding financial decisions and prevent taking advantage of opportunities for improvement.

Pain point 2

Influence of consumer culture-Constant exposure to images and displays of luxury products and experiences leads to unplanned spending and difficulty managing a personal budget, as the desire to conform to the social image outweighs real economic needs.

Pain point 3

A challenge in financial management and dealing with debt- Most people don't like numbers and tables and have difficulty keeping informed track of expenses and income, which causes a monthly deficit.

Pain point 4

Lack of practice and supportive experience for saving- the strong desire to get rich in the Western world is not supported by the reality of life despite knowing the importance of saving and investing to get there.

Market Research

After understanding the main pain points of users, I researched the market, with the aim of understanding whether there are currently solutions and how they function. I researched direct competitors in the field of financial management, in the field of savings and investment management, also solutions for couple financial management and more... and even indirect competitors that provide different social solutions but on different topics.

Conclusions

There is currently no single holistic solution to this problem, competitors solve different problems in the economic space with varying degrees of success.

Connecting to banks is necessary for tracking, but also cumbersome and unintuitive, in cases of switching banks, or staying in two countries

Competitors have difficulty parting with diagrams and tables, which is something that most people shy away from.

Takeaway

Using the wisdom of crowds creates social connection and knowledge sharing

Keep a practical tool, otherwise your system will lose its usefulness

Give two types of gaze, far and near - this gives a sense of control and certainty.

Find a way to reward your users in places where a little more user activity is required, but this is important enough to ensure the effectiveness of the system.

Be innovative, and use new technologies and artificial intelligence

Formulating solutions

Efficient but open.

Efficient but open.

A system that balances user engagement and automation

purpose

Keeping it simple and convenient but without restrictive regulation for users around the world

Main operations

Purchase automation by reading purchases made over the phone

.Scanning receipts by phone and automatically entering the data into the syste

Memos for independent data entry by the user such as income, savings, budget

Intuitive practice.

Intuitive practice.

Personal financial management tool

purpose

An intuitive experience in financial management

Main operations

Responsible for 4 main categories, cash flow, monthly budget, assets, liabilities

Intuitive budget management

Displays the monthly balance and the overall financial balance at any given moment.

Innovation is the word.

Innovation is the word.

Artificial intelligence system

purpose

Channeling the wisdom of crowds for the benefit of the user

Main operations

Data collection

User location on the map

Chat

Value simulations

Active help in personal management

Architecture

After thinking about the solutions together with the client, I started the complex work of the architecture. The system is very complex, so I had to create different types of architecture. Such as product architecture, components, and more.

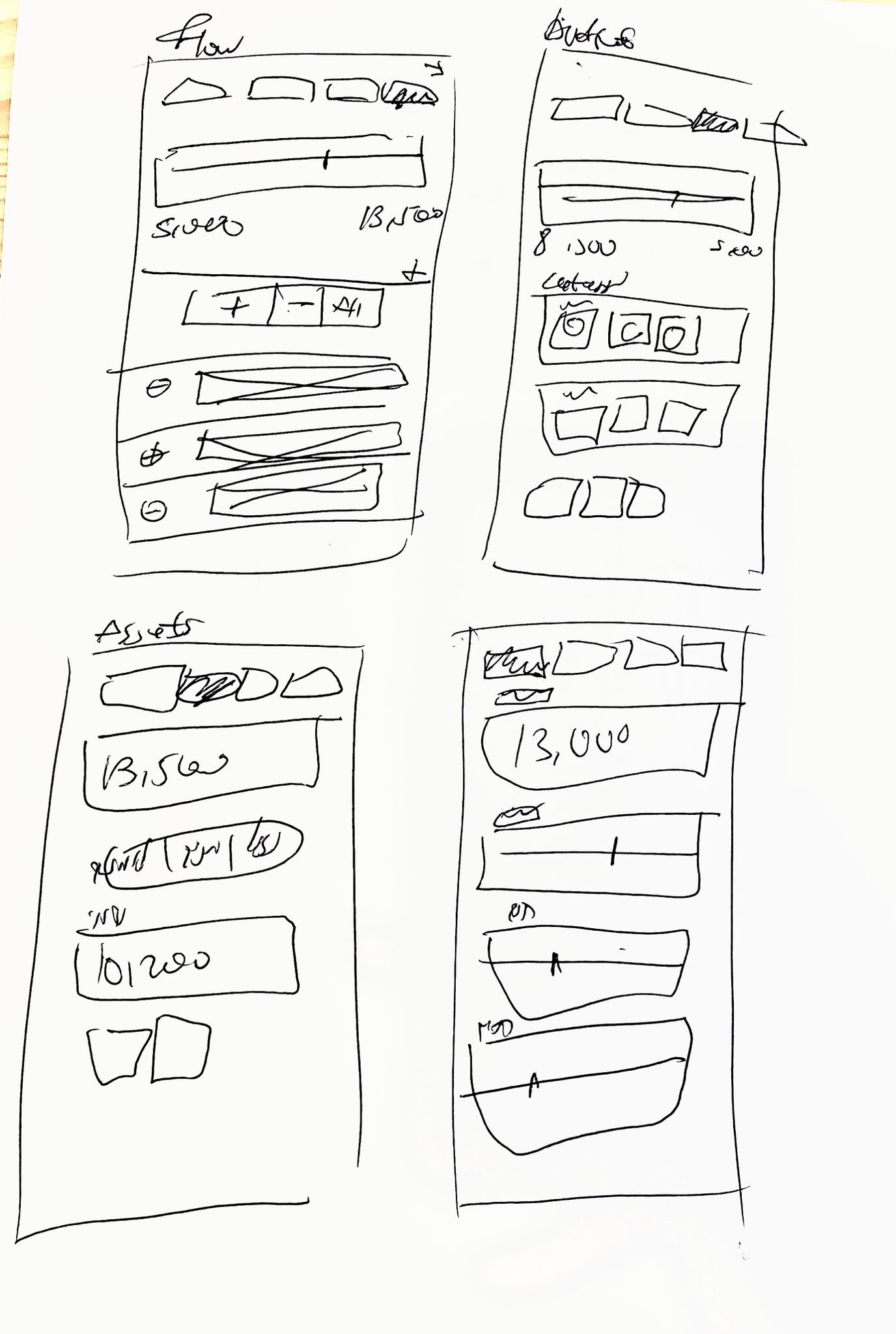

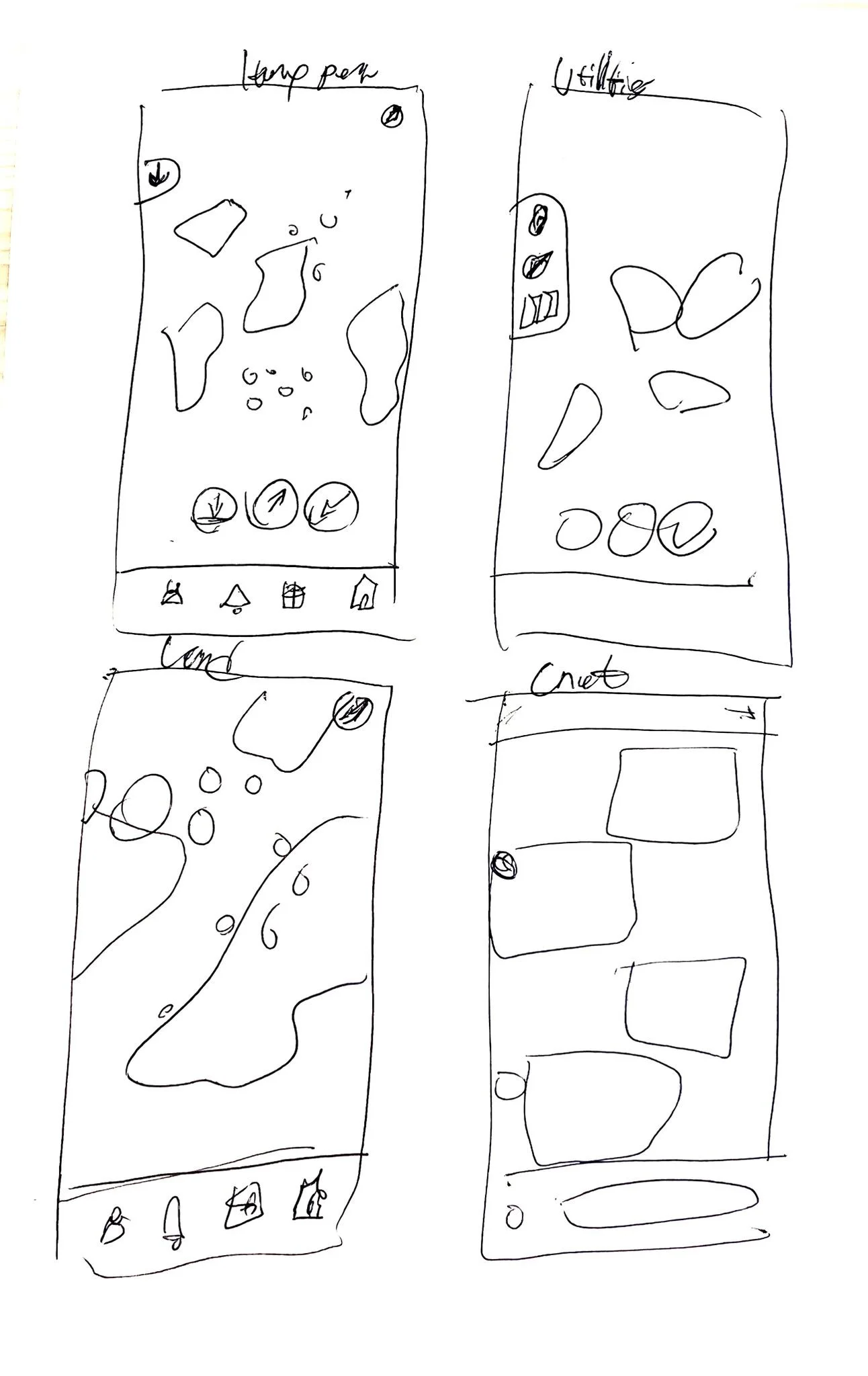

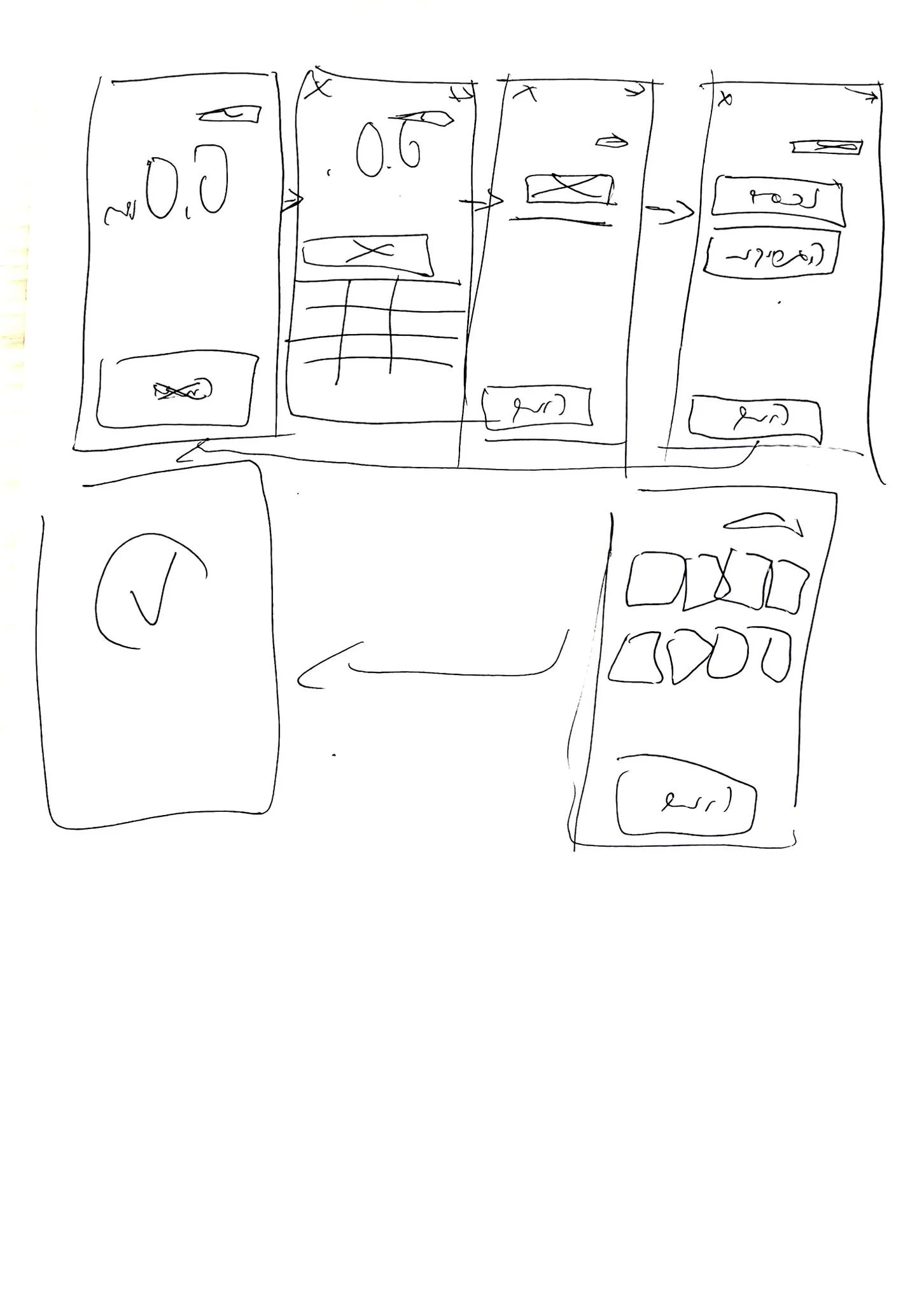

Wireframes

I started by throwing the solutions I came up with onto a page, then got down to the details. Every button and feature has a purpose, and its placement was chosen to serve the key user needs I determined based on the research and insights that resulted from it, and the business goals.

Get a look of a real product

The creation of the detailed screens is still in progress, It combines the user flows of the main action buttons, and the main screens of the management tools. Here is a small sample of the management tools and user flow of main actions.